Positive Pay System Punjab National Bank: Attention PNB Customers! Now this work will have to be done before check clearance, the bank has given information. If you are a customer of Punjab National Bank (PNB), then there is very important news for you. Customers of Punjab National Bank (PNB) will have to give information a day in advance for clearing high amount cheques.

Positive Pay System of Punjab National Bank

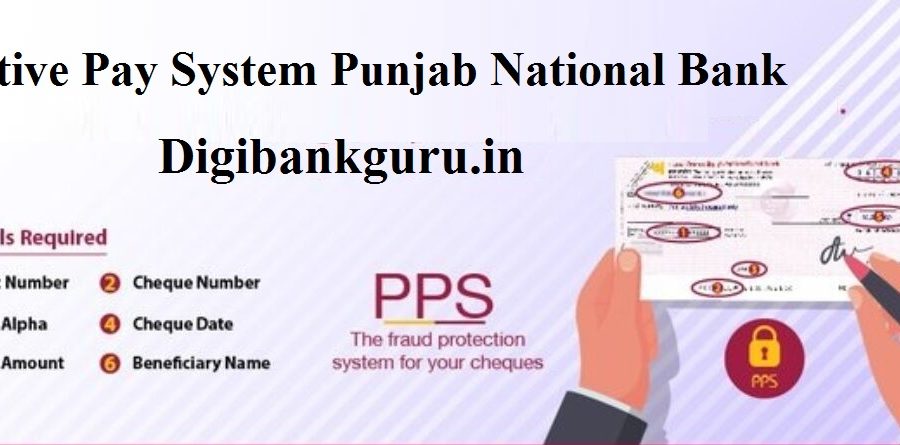

If you are a customer of Punjab National Bank (PNB), then there is very important news for you. Customers of Punjab National Bank (PNB) will have to give information a day in advance for clearing high amount cheques. The bank has taken this step to protect the customers from fraud. Explain that the National Payments Corporation of India (NPCI) had prepared a Positive Pay System (PPS) in this regard. Under this, customers issuing a high denomination check are required to re-verify the check number, check amount, date, and beneficiary name.

Positive Pay System Was Implemented On April 4

PNB implemented the PPS system on April 4, 2022, for checks valued at Rs 10 lakh and above. According to the bank, if customers issue checks of ₹ 10 lakh and above through a bank branch or digital channel, then PPS confirmation will be mandatory. Customers have to provide an account number, check number, check alpha, check date, check amount, and beneficiary name.”

Information To Be Given A Day Before

“As per the guidelines, customers are required to submit their check details at least one working day prior to clearing to ensure a smooth verification process and avoid a return of checks,” the bank said in a release on Friday.

What is Positive Pay System?

Positive Pay System is a kind of fraud detection tool. Under this system, when anyone issues a check, he will have to give full details to his bank. In this, the issuer of the check will have to electronically give the date of the check, beneficiary name, account number, total amount, and other necessary information to the bank through SMS, internet banking, ATM, or mobile banking. With this system, while the payment by check will be safe, the clearance will also take less time. The physical check issued in this does not have to move from one place to another. It is a very easy and safe process.